|

This resource from the White House was provided to state governors on April 16, 2020, during a phone call about next steps for the country. The document outlines guidelines for reopening the states as the coronavirus pandemic eases. It's unclear how these plans may change in the future. Download the PDF below.

TWFG Russell Knapp | Our Policy is Caring! | (281) 466-1310

0 Comments

The safest and most efficient way to communicate with your TWFG Agent and access your Insurance Policy Information.

Follow the step by step instructions below to get you started. Download Our App:

Once Downloaded:

Setup Your Access:

Once Logged in, You Can:

For more information about the mobile app, please contact TWFG Spring / The Woodlands. Given the implications of the coronavirus (COVID-19) outbreak, countless employees across a variety of industries are working remotely. While this allows businesses to remain operational, it can create a number of risks, particularly for those who fail to take the proper precautions.

Above all, information security is one the greatest challenges for companies allowing remote work during the COVID-19 outbreak. When an employee is at the office, their work is protected by safety standards that keep your company’s network and data secure. However, an employee working from home may not have the same safety measures in place to protect your organization’s devices and information. In order to safeguard your business and employees from data breaches, cyber scams and viruses, consider the following strategies:

For additional protection, employers should consider backing up data and bolstering network protections as best as they can. For more cyber security insurance or guidance, contact TWFG Spring / The Woodlands. Inland marine insurance was once used strictly in the ocean marine industry to protect against property losses before, during and after water transfers. As the non-ocean aspect of the cargo journey developed, cargoes were transferred to barge, and the term “inland marine” was created. These policies became known as “floaters” because the property covered was originally floating in the ocean.

In the modern insurance industry, inland marine coverage provides protection to fill any gaps in commercial property protection or to reach specific limits of coverage. Industry-Specific Coverage Inland marine insurance can provide specific coverage by industry to protect against a wide array of exposures:

Additional Resources Consult TWFG Insurance - Russell Knapp today to learn more about inland marine insurance to protect items that seem to fall between the lines of your current coverage. We have the expertise to help you to mitigate your risks and protect your bottom line. According to the Centers for Disease Control and Prevention (CDC), coronaviruses are common in animal species, and most don’t affect humans. As of now, only seven different coronaviruses are known to infect humans. In their lifetime, most people will be infected with at least one common human coronavirus.

What are the symptoms of coronavirus? Common coronaviruses typically cause mild to moderate upper-respiratory tract illness, and those affected exhibit cold-like symptoms. The most common symptoms include:

How is coronavirus diagnosed? If you’re exhibiting coronavirus symptoms, you should call your doctor, especially if you’re experiencing symptoms and have traveled to countries where outbreaks have been reported. Your doctor will likely order a lab test to detect coronavirus. Be sure to disclose any recent travel to your doctor. Deadly Outbreaks of Coronavirus The 2019 novel coronavirus, as well as two other human coronaviruses, have caused severe symptoms. In 2012, the Middle East Respiratory Syndrome Coronavirus (MERS-CoV) outbreak caused severe illness—nearly 4 out of 10 people infected died. The severe acute respiratory syndrome coronavirus (SARS-CoV), which was first reported in Asia in 2003, spread to two dozen countries, infected 8,098 people and caused 774 deaths before it was contained. How can I prevent coronavirus infection? Most common cases of coronavirus occur in the fall and the winter, but can happen at any time throughout the year. Unfortunately, there is not a vaccine that can protect you from human coronavirus infection. However, because human coronavirus is believed to be spread through person-to-person contact, the CDC recommends the following prevention strategies:

For more information about coronavirus visit the CDC here. Each year, the Occupational Safety and Health Administration (OSHA) tracks and shares its most frequently cited standards. OSHA hopes that by releasing this enforcement data, businesses will take steps to identify and address potential safety issues. For the 2019 fiscal year, the 10 most frequently cited standards from 2018 all remained on the list, although their order changed slightly. The following list includes more information on the most common citations during the 2019 fiscal year. Top 10 OSHA Violations 1. Fall Protection (29 CFR 1926.501) Fall protection topped the list of most frequently cited OSHA standards for the ninth consecutive year. Falls from ladders, roofs and other heights continue to be the leading cause of injuries at work, so identifying fall hazards and making sure that you are doing everything in your power to protect your workers should be a top priority. Some safety precautions that you should always consider implementing include guardrails, safety nets and personal fall protection systems. It is important that employees are properly trained in the use of this equipment and that your workplace also has good general safety practices. 2. Hazard Communication (29 CFR 1910.1200) Hazard communication has been in the No. 2 spot on this list for several years. OSHA standards require that businesses keep track of hazardous chemicals in the workplace in order to keep their employees safe. This standard applies to chemicals either produced or imported into the workplace. Companies are often cited for failing to develop or maintain a proper written training program, inadequate training and not providing safety data sheets for each hazardous chemical that employees will be dealing with. 3. Scaffolding (29 CFR 1926.451) Scaffolding violations have been toward the top of OSHA’s most frequently cited standards throughout the past decade. Many scaffolding violations stem from a lack of guardrails, improper decking and supported scaffolds being positioned on inadequate foundations. 4. Lockout/Tagout (29 CFR 1910.147) Lockout/tagout (LOTO) moved up to the fourth-most cited OSHA standard for the 2019 fiscal year from fifth in 2018. LOTO refers to safety procedures and practices used to prevent machinery or equipment from unexpectedly starting and potentially injuring employees. Employers were often cited for inadequate training, not regularly evaluating their procedures and for notestablishing an energy control procedure at all. Employees who use mechanical or electrical equipment face the greatest risk of injury if LOTO is not properly implemented. 5. Respiratory Protection (29 CFR 1910.134) OSHA standards require employers to establish and maintain a respiratory protection program. Proper respiratory protection helps to keep employees safe from hazards such as oxygen-deficient environments and harmful dusts, fogs, smokes, mists, gases, vapors and sprays. Such hazards can lead to cancer, lung problems and death. In 2019, employers were frequently cited for failing to provide medical evaluations, not conducting required fit testing and not having an established program. 6. Ladders (29 CFR 1926.1053) Ladder violations often stem from inadequate siderails for a landing surface, use of defective ladders, improper use and using the top rung of the ladder as a step. The main factors that lead to injuries are a lack of training and a disregard for safe ladder practices. 7. Powered Industrial Trucks (29 CFR 1910.178) Each year, thousands of workers are injured in accidents involving powered industrial trucks—especially forklifts. Many of these injuries occur when trucks are driven off loading docks, or fall between docks and unsecured trailers. Injuries also often stem from being struck by lift trucks or falling from elevated pallets and tines. Common violations included defective or damaged trucks not being removed from service, failing to evaluate operators every three years and failing to retain certification. 8. Fall Protection Training Requirements (29 CFR 1926.503) OSHA standards require employers to train employees on identifying potential fall hazards and fall protection procedures. Employers were often cited for not providing training to employees, not certifying the training in writing, and inadequate training or retraining. According to OSHA, training should include the use of fall protection methods such as guardrails, safety nets and personal fall arrest systems, and employers should also verify that employees completed the training by keeping written certification records. 9. Machine Guarding (29 CFR 1910.212) Moving machine parts can cause serious workplace injuries, such as amputations, crushed fingers or hands, burns and blindness. Proper machine guarding is an important part of reducing these risks. Failing to guard points of operation, ensure that guards are securely attached and properly anchor fixed machinery were among the common violations for this standard. 10. Eye and Face Protection (29 CFR 1926.102) Eye injuries cost employers millions of dollars each year due to medical expenses, workers’ compensation and lost production time. It is important that employees are provided with appropriate eye and face protection to stay safe from chemical, mechanical, environmental and radiological hazards. Common violations include not providing adequate protection in environments with flying objects, caustic hazards, gases and vapors, as well as failing to provide equipment with side protection. TWFG Spring / The Woodlands | (281) 466-1310 | www.insuringhouston.com Workmans Compensation Insurance- Commercial Insurance - Spring, Tx - TWFG Spring / The WoodlandsYour credit score is one of the most influential factors when it comes to financial outcomes in your life. Most people know that their credit scores affect their ability to obtain a mortgage or loan. What’s more, most people understand that the interest rates they pay on loans is tied to their credit scores. However, there are even more aspects of your life that are influenced by your credit score.

In fact, your insurance premiums can be directly affected by your credit score, which means that if your score isn’t great, you’ll be paying more for your coverage. Insurance Scores Many insurance companies use your credit score to generate a credit-based insurance score that is then used as a factor in determining your premiums. Credit-based insurance scores and your credit score are not the same thing. Insurance scores focus on only some factors of your credit history in order to gain an indication about how you manage risk. Factors that may be used include: • Payment history • Amount of debt • Length of credit history • Recent applications for new credit • Types of credit you have In some states, insurance companies are limited in whether they can use credit-based insurance scores and, if so, to what extent. While influential, credit-based insurance scores are only one factor in a company’s process of determining your premiums. Auto insurance companies, for example, could consider factors such as your location, age, the model and age of your vehicle, and how much you drive. Improving Your Score The easiest way to improve your credit-based insurance score is to increase your actual credit score. A healthier credit score can lead to lower premiums and put money back into your pockets. In addition, the higher your credit score, the better terms you will receive on loans and credit cards. As such, having a good credit score is helpful not only for the present, but also for your financial future. Some steps that you should consider taking to improve your credit score include: • Be punctual—Paying your bills on time is a key factor in maintaining or improving your credit score. • Pay it back—Reducing the amount of overall debt that you have is a good way of improving your score. • Keep it open—Paying off a credit card feels great, but even if you don’t owe any money, you should still keep the account open. • Limit new debt—Keep the amount of applications you make for new credit to a minimum. • Maintain balance—Having a wide variety of types of credit, such as a mortgage, auto loan, credit card and personal loan can contribute positively to your credit score. Need help finding affordable insurance? Give TWFG Spring / The Woodlands a call (281) 466-1310. Did you know that children are more than twice as likely to be hit by a car and sustain fatal injuries on Halloween than on any other day of the year? In 2017, October ranked No. 2 in motor vehicle deaths by month, with 3,700.

Kids love the magic of Halloween: Trick-or-treating, class parties and haunted houses. But for parents there is a fine line between Halloween fun and safety concerns, especially when it comes to road and pedestrian safety. In 2017, 7,450 pedestrians died in traffic or non-traffic incidents, according to Injury Facts. Non-traffic incidents include those occurring on driveways, in parking lots or on private property. 18% of these deaths occurred at road crossings or intersections. Lack of visibility because of low lighting at night also plays a factor in these deaths. Costume Safety To help ensure adults and children have a safe holiday, the American Academy of Pediatrics has compiled a list of Halloween safety tips.

When They're on the Prowl

Safety Tips for Motorists

Source: National Safety Council By now, you’ve probably seen a few people cruise by on an electric scooter. They may have been a few teenagers on their way to a friend’s house, somebody using the vehicle as a new way to commute to work, or maybe it was even yourself doing the riding. E-scooters have become common in many cities across the United States, with industry leaders Bird and Lime reporting millions of rides so far.

But, while e-scooters might be revving up in terms of popularity, new technology brings new complications and new concerns. What are e-scooters? E-scooters are not to be confused with mopeds or Vespa-like scooters, which allow users to sit, and travel at relatively high speeds. Rather, e-scooters are operated while standing up and often cannot go faster than 15 to 20 mph. Users get started by downloading an app that will help them find a nearby e-scooter. They can then unlock the vehicle for an initial starting fee with total payment being calculated according to either distance traveled or how long the user rides the scooter. E-scooters are usually dockless and operate like dockless bike-sharing programs with users able to find and park the vehicles in a wide variety of locations. E-scooters often do not require the operator to have a driver’s license. Know the Risks and Rules While operating an e-scooter, users are required to obey state and local traffic laws, but these can vary greatly depending on where you live or where you’re riding. Some jurisdictions have implemented laws pertaining specifically to e-scooters that limit where they can be ridden and how fast they can travel, so make sure you are familiar with the local rules before you take a ride. Even if you are certain that you’re not breaking any laws, operating any type of motor vehicle, even an e-scooter, brings a certain amount of risk. E-scooters might not travel as fast as cars, but even at speeds as low as 15 mph, an accident involving a rider, pedestrians or other motor vehicles can lead to serious injuries including broken bones, head injuries and soft-tissue injuries. Where Does the Finger Point? With e-scooters still being a relatively new form of transportation, many insurance companies are still inconclusive on how coverage and liability applies to accidents and injuries caused or suffered by riders. You may be riding at your own risk when you step onto a scooter, so it’s important to know whether you’re covered under your own insurance policies. Your homeowners and auto insurance policies may have been created before the rise of e-scooters, so there may be no mention of the devices. A standard homeowner policy does not cover motor vehicles, and standard personal auto policies exclude liability coverage for vehicles with less than four wheels—e-scooters generally have two. Motorcycle insurance also might not cover e-scooters. Personal liability umbrella policies provide coverage for incidents excluded from underlying insurance policies, and thus may provide coverage for e-scooters. It is important to know the specific details of your homeowners and auto policies before you can count on coverage for an injury or accident involving an e-scooter. Contact TWFG Insurance Spring / The Woodlands today for more information. Mental health plays a huge role in your overall health and well-being. It affects everything, including how we think, feel and act, and helps determine how we make healthy choices and cope with stress. Because it’s such a crucial component of your health, it’s important to focus on maintaining or improving your mental health. Here are five simple ways to do so every day:

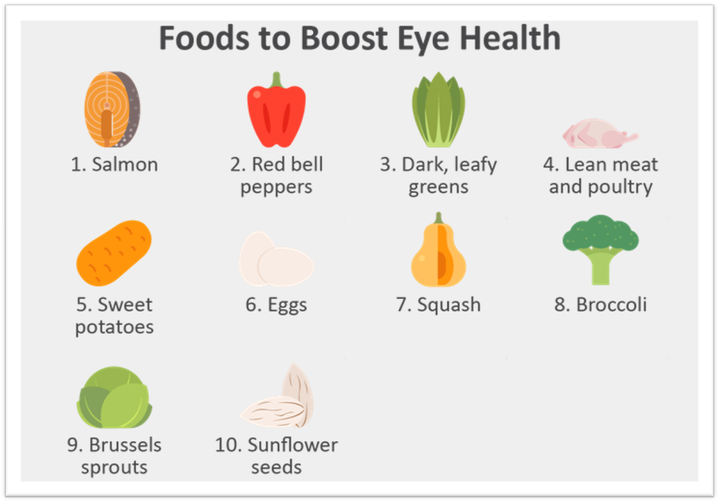

Eye Health 101 Keeping your eyes healthy is a very important task. Fortunately, it’s also an easy thing to do. Here are five simple ways you can keep your eyes healthy:

The Unexpected Ingredient in Your Oats

It’s not a superfood, and it’s not naturally occurring. It’s a pesticide. According to a report by the Environmental Working Group (EWG), almost three-quarters of the oat cereal, oatmeal, granola and oat bars contained traces of glyphosate. What’s glyphosate? Glyphosate is one of the most widely used herbicides in the world. It’s the main ingredient in hundreds of weed-killing pesticides. Are oats safe to eat? Federal officials report that the levels found in the oats is deemed to be “safe.” However, EWG claims that no level of exposure is safe, as glyphosate was classified as a probable carcinogen in 2015. To reduce your exposure, but still eat your oats, opt for organic oats. -TWFG Insurance Spring Tx - The Woodlands (281) 466-1310 |

|||||||

RSS Feed

RSS Feed